An Initial Coin Offering (ICO) is a cryptographic space that is not comparable to an IPO in the world of standard speculation. ICO acts as a leading driver; an organization that hopes to make coins, applications or other administrations send ICOs. Furthermore, financial specialists who are interested in buying for offers, either in cash or with previous computerized tokens such as ether. In return for their assistance, financial specialists get other digital currency tokens explicitly to ICO.

Financial specialists believe that tokens will perform very well in the future, giving them a very good rate of profit. Organizations that hold ICO use financial specialist assets as a method to push their goals, push their items, or start computerized cash. ICO is used by new companies to avoid a comprehensive and directed procedure for increasing capital needed by investors or banks.

An important factor identified with the ICO is that assets are raised at once. In other words, it is not at all like ordinary effort advertising, speculators do not finance each stage of item creation when investigating its quality and independently provide assets to be displayed in a number of funding rounds. No, ICO collects a large amount of dollars at the same time for the entire business range until then it ends independently. In this way a business with the ICO can continue to promise wealth for speculators for several years, while basically having zero budget control.

Basically, tokenization is a way to create digital money tokens that are added to something from the current reality. It tends to be anything, from gold and land to maintaining money administration and monetary instruments. No doubt the blockchain can provide more prominent candor in relationships between individuals and if something becomes a token, at that time all the financial relationships associated with this item will end up more difficult and more reliable.

Blockchain and cryptographic forms of money are quite new advances, which are opening up new markets. With its own form of digital money and the enthusiasm of the standards for those who are developing fast lately, this innovation is offered to many new companies, increasing assets through the ICO or through increasingly common business choices. Most businesses are identified with said tokenization.

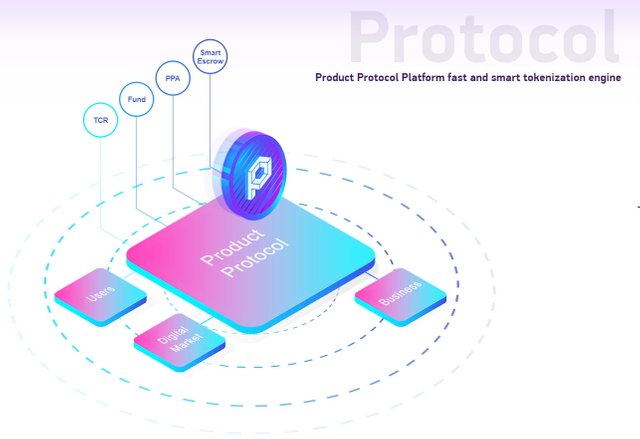

Token liquidity issues are explained effectively as a result of the Protocol through the option to issue and trade blockchain resources on their own, the blockchain, every move to tokized resources takes place only on the platform. Exchange, exchange, agreement with the final buyer, trading of items pegged to current reality every last bit is carried out through the Product Protocol.

An integral part of the calculation of tokenization in the Product Protocol stage is the Open API and IoT innovation to make further duplicates of the benefits associated with the first progressively. This is to specify further descriptions. This will be sufficient to guarantee 100% ID is computerized from each corrosive unit.

For each type of market, there must be a product of the buyer who is responsible at the request of the buyer with an estimate of standing (fundamental). A small portion is a non-material sign and is a basic measure of benefits in the framework.

Data for digitization, tokenisation and observing benefits will be sent and confirmed to use many numbers, square chains. Clients will get access to check data settings on resources and ownership in real time. Preparation and decentralization of the capacity to move away from the possibility of irreconcilable circumstances and possible intrigue between tokenization participants, work partitions and decentralization rules will work tricks

As an important defense against acceleration.

The Product Protocol Team provides application designers incorporated with square chain platforms, strong instruments that will provide standards for developing new applications and services. Open Product Protocol, universal review, this is a trading criterion for important data about the possibility of customized application resources.

This convention means to protect data ID by using the most enhanced cryptosystem. The Product Protocol is centered around application programs and empowers tokenization and the original resource board.

The item convention assumes several jobs. From one point of view, it is a facade facing the customer where the buyer can come to buy an item. Buyers can take advantage of tickers of superiority that can be traded for original resources in broad conditions. Regarding money-related resources, it might be another bank or Internet stage, or a web-based business, trade, merchant, or insurance agent.

Product Appraisal Services: Administrative assessments for valuing and tokenizing resources, collecting first data on benefits, scientific data and resource tokens.

DAsset System: is an outstanding framework that checks data about physical and advanced resources, Advanced framed holders. What’s more, there are associations with and from compartments to resources.

DAsset: computerized compartments or circulated metadata bundles that negotiate everything that matters.

To recognize data about resources, the Product Protocol combines two main calculations that are actualized continuously. Proof of the Asset Algorithm is a calculation for the identification of resources. Benefit ID and real-time computerized data about that data. After collecting, verifying, analyzing, compiling, encrypting, and transferring data about its advantages, Virtual Tokens

Issuance of extra Virtual Atom Tokens to recognize the least divided standing or resource resources, for example, square meters. The Virtual Token contains open data about the status of asset files. Data depends on data obtained from the Asset through the Asset Monitoring System and is stored in a progressive DASset compartment of virtual Token resources.

Agreement on the subject involves several tasks. From one point of view, this is a facade facing the buyer, where buyers can come to buy an item. Buyers can use the benefits ticker, which can be exchanged for genuine resources in extensive conditions. As for money-related resources, it can be a bank or other online platform, or a web-based business, trading, merchants or insurance agencies.

- Product Evaluation Services: Evaluation Administrations for assessing and tokenizing resources, collecting first data on benefits, scientific data, and resource tokens.

- DAsset system: this is a common structure that checks data on physical and additional resources, the owners of Advanced are substituted. Moreover, there are associations with compartments and resources.

- DAsset: a circulating computerized compartment or set of metadata that sets out everything that it produces.

To recognize resource data, the product protocol includes two key calculations that are updated continuously. The asset confirmation algorithm is a calculation for identifying a resource. Computerized benefit identifier in real time and data about it. After collecting, verifying, analyzing, structuring, encrypting and transferring data about the benefits of a virtual token

Issuance of additional Virtual Atom tokens for recognition of permanent resources or least indivisible resources, for example, square meters. A virtual token contains open data about the status of the asset file. The data depends on the data obtained from the assets through the asset monitoring systems and is gradually deposited in the extended compartment of the DAsset virtual resources.

TOKEN SALE

DISTRIBUTION OF FUNDS:

- 30% - marketing and first tokenized products

- 35% - development fund and PP coins

- 10% - lawyer, salary, lawyers

- 10% - technological support

- 15% - team

DETAILED DETAILS:

- 65,000,000 PPO - ICO

- 15,000,000 PPO - team and partners

- 15 000 000 PPO - platform support

- 5,000,000 PPO - Marketing and Consultants

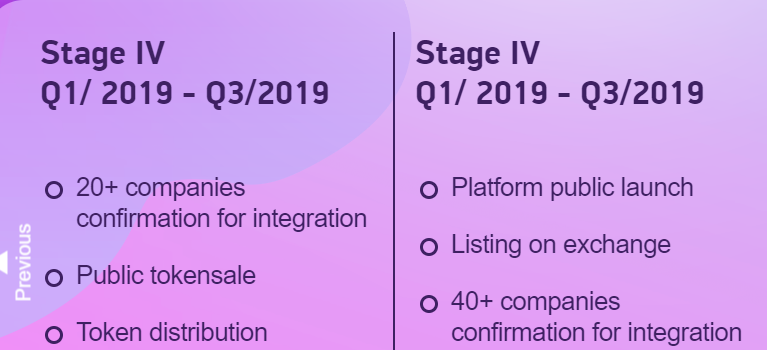

ROADMAP

PRODUCT PROTOCOL TEAM

PARTNERS

For more information you can visit the link below:

Website: https://pprotocol.io/en/

Facebook: https://www.facebook.com/pprotocolio

Twitter: https://twitter.com/Pprocolocolobal

Telegram: https://t.me/productprotocolio

Kakao Talk: https://open.kakao.com/o/gvAI0sbb

Ann Thread ( https://bitcointalk.org/index.php?topic=5113105

Menthil85

My Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=2215446

My ETH Address : 0xcfAA89619e4e36d9F9a024Fe02Ce30afa04Bcaa3

0 Komentar